FLYACTS Overview

FLYACTS is a cutting-edge technology company based in Jena, Germany, that specializes in providing a wide range of services including digital marketing, artificial intelligence, and blockchain develop... Read More

Services

44 services offered by FLYACTSReviews

4 reviews for FLYACTSEs sollte eine auf uns zugeschnittene App erstellt werden, welche unsere digitalen Dienste zusammenfasst und somit dem Kunden einen zentralen Anlaufpunkt bietet. Die konstruktiven Diskussionen über Lösungsvorschläge sowie der interessante Austausch untereinander.

Validierung unseres Geschäftsmodells. Gemeinsam mit Flyacts haben wir in Workshops erarbeitet, was Sinn macht und dies mithilfe von Umfragen und einer Ads-Kampagne validiert der persönliche, professionelle und super schnelle Kontakt mit dem Team

Entwicklung einer mobilen App im Bereich Food & Lifestyle. FLYACTS hat nicht nur entwickelt, sondern auch die wirtschaftliche Perspektive im Blick gehabt, das hat uns sehr gefallen.

Zusammen mit FLYACTS haben wir validiert, wie gut unsere digitale Geschäftsidee ist und ob wir erste zahlende Kunden dafür gewinnen können. Zu sehen, wie schnell FLYACTS in kürzester Zeit Ergebnisse abliefert. Das Team war echt super!

Portfolio

9 projects performed by FLYACTS

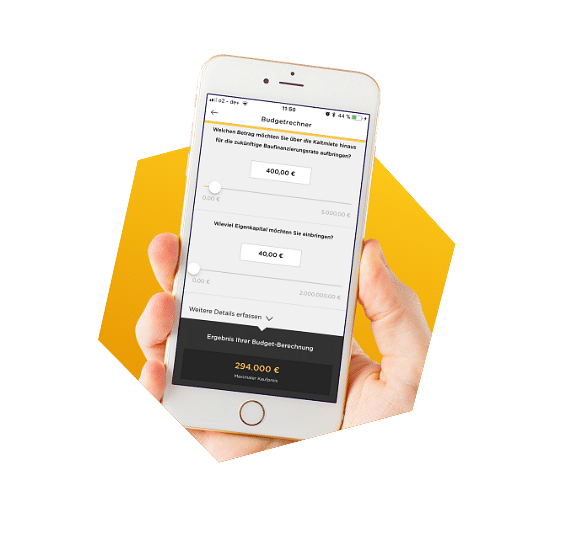

Commerzbank - Erste deutsche Baufinanzierungsapp is a project focused on providing a user-friendly and efficient mobile app for German customers looking for mortgage financing options. The app aims to streamline the process of finding and applying for home loans, making it easier for users to navigate the complex world of real estate financing.

Bundeswehr Cyber Innovation is a project aimed at enhancing the cybersecurity capabilities of the German military. Through innovation and collaboration, the project seeks to address the evolving cyber threats faced by the Bundeswehr.

HOLTEC - Eine revolutionäre Kundenbeziehung is a project aimed at transforming customer relationships through innovative technology solutions.

DIHK - Motivierende Lern-App für IHK Prüflinge is a mobile application designed to motivate and assist IHK exam candidates in their exam preparation. The app provides a user-friendly platform for studying, practicing exam questions, and tracking progress.

Rhenus Neo App - Bessere Mitarbeiterbindung is a project aimed at improving employee engagement and retention through the use of a mobile app. The app provides a platform for employees to easily access company information, communicate with colleagues, and participate in various engagement activities.

SwissLife - Parken 4.0 schafft neue Einnahmequelle is a project aimed at revolutionizing the parking industry by introducing innovative technologies and solutions to create new revenue streams.

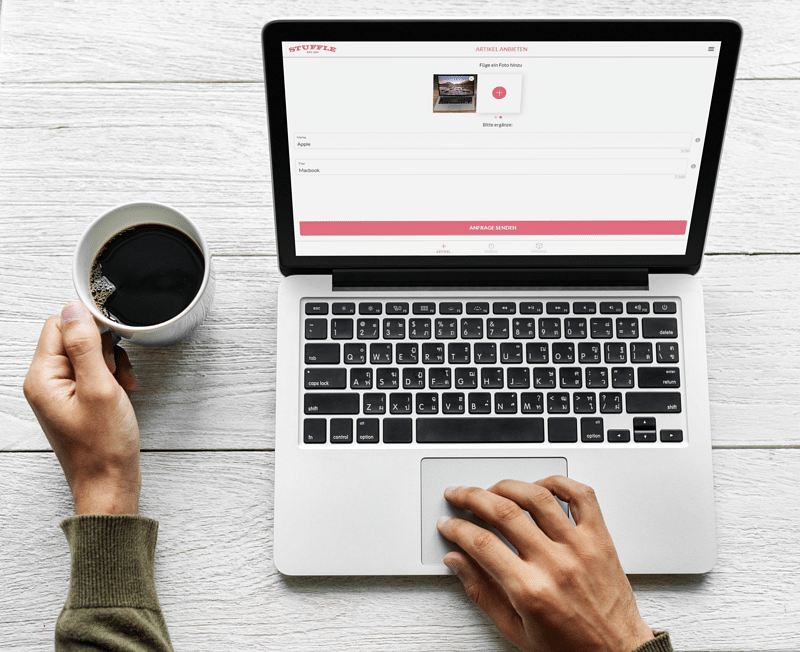

Stuffle - Die Disruption des Re-Commerce is a cutting-edge project aimed at disrupting the re-commerce industry. Through innovative technologies and a user-friendly mobile app, Stuffle is revolutionizing the way people buy and sell used goods.

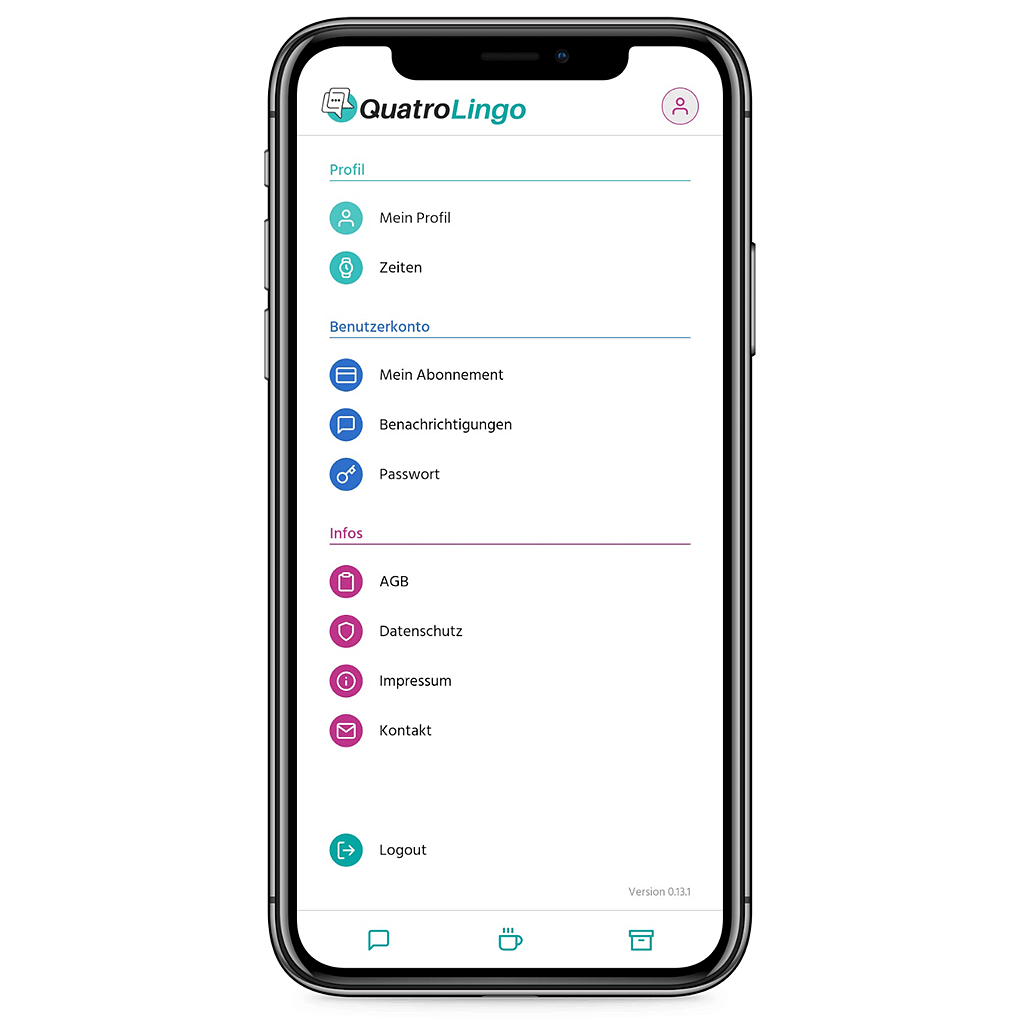

Quatrolingo is an innovative platform that revolutionizes the way freelance professionals find and secure job opportunities. The platform connects clients directly with skilled individuals, eliminating the need for middlemen and providing a more efficient and cost-effective solution for both parties.

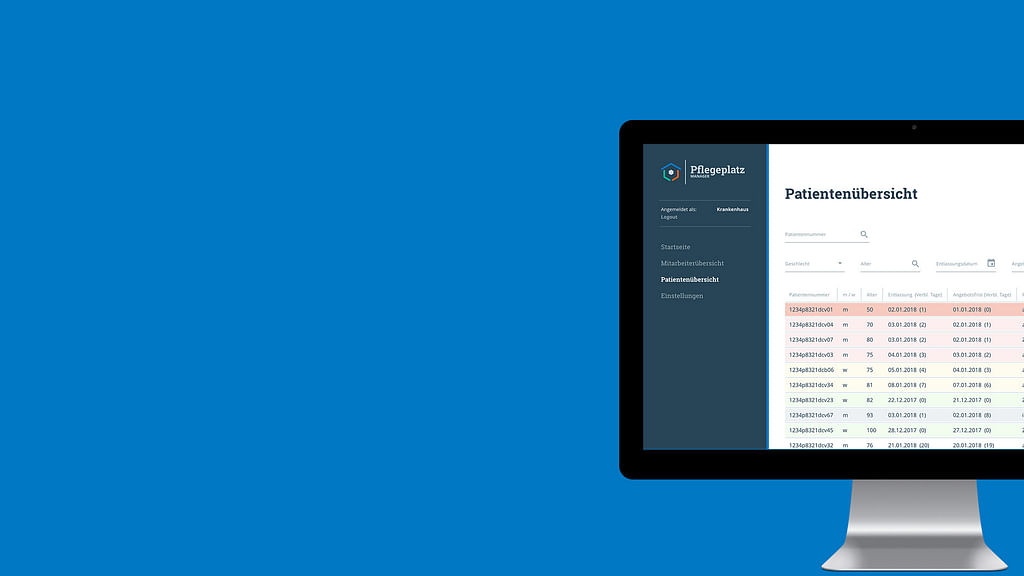

Pflegeplatzmanager - Rapide Umsetzung für Startup is a project aimed at creating a platform that helps connect individuals in need of care with available care facilities quickly and efficiently.

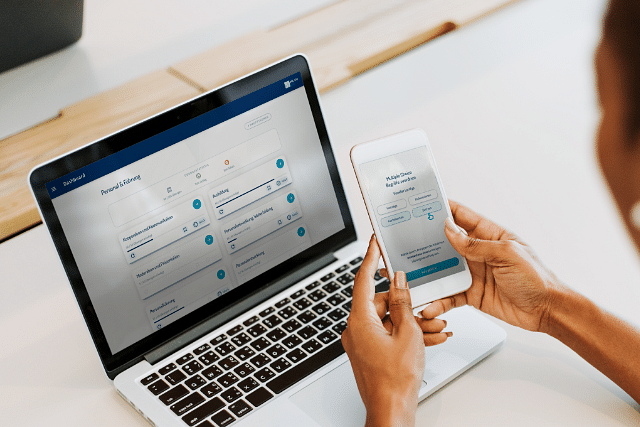

Commerzbank - Erste deutsche Baufinanzierungsapp

by FLYACTS

Description

Commerzbank - Erste deutsche Baufinanzierungsapp is a project focused on providing a user-friendly and efficient mobile app for German customers looking for mortgage financing options. The app aims to streamline the process of finding and applying for home loans, making it easier for users to navigate the complex world of real estate financing.

Challenge

One of the main challenges faced by potential homebuyers in Germany is the overwhelming amount of information and options available when it comes to mortgage financing. Navigating through various lenders and loan products can be daunting and time-consuming for customers.

Additionally, the traditional process of applying for a mortgage can be cumbersome, involving multiple visits to banks and extensive paperwork. This can be a barrier for many individuals looking to purchase a home.

There is a need for a digital solution that simplifies the mortgage financing process and provides users with a seamless and convenient experience from start to finish.

Solution

The Commerzbank - Erste deutsche Baufinanzierungsapp addresses these challenges by offering a mobile app that aggregates information from various lenders and presents users with personalized loan options based on their preferences and financial situation. The app also provides tools for calculating mortgage payments and comparing different loan products.

Through the app, users can easily apply for a mortgage online, track the progress of their application, and receive notifications on important milestones. This digital solution streamlines the mortgage financing process, making it more accessible and transparent for customers.

By leveraging technology and automation, the app eliminates much of the paperwork and manual processes associated with traditional mortgage applications, saving users time and effort in securing their home financing.

Impact

The Commerzbank - Erste deutsche Baufinanzierungsapp has a significant impact on the homebuying experience for customers in Germany. By providing an intuitive and efficient platform for mortgage financing, the app empowers users to make informed decisions and navigate the real estate market with confidence.

With the convenience of mobile access and streamlined application processes, more individuals are able to pursue their dream of homeownership, contributing to a more vibrant and inclusive housing market in Germany.

The digital transformation of mortgage financing through the app also benefits lenders by improving operational efficiency and customer satisfaction, ultimately driving growth and competitiveness in the financial services sector.